Industrial park incentives are one of the factors that secondary investors are always interested in when investing in industrial land. The following information about industrial park incentives will help you choose the most favorable investment location today.

1. Incentive form for investment in industrial parks

When investing in industrial parks, businesses will receive many incentives on tax and land rent. As follows:

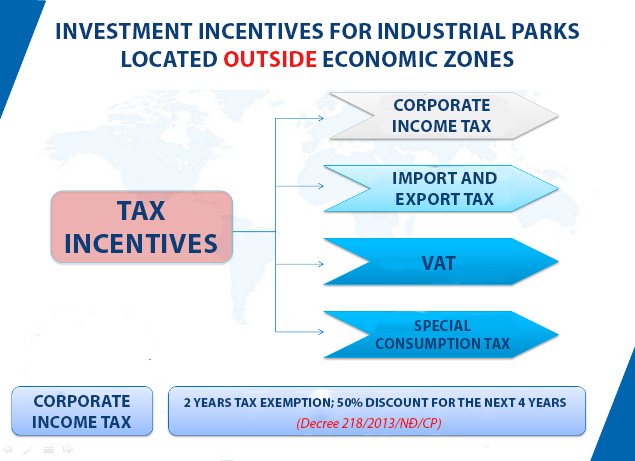

CIT incentives

According to the regulations of the Ministry of Finance, Article 6 of Circular No. 151/2014/TT-BTC stipulates:

“ Tax exemption for 2 years and reduction of 50% of payable tax amount for the next 4 years for income from the implementation of new investment projects specified in Clause 4, Article 9 of Circular 78/2014/TT-BTC and income of enterprises from implementing new investment projects in industrial parks (except for industrial parks located in areas with favorable socio-economic conditions) .

Thus, new investment projects (not located in areas with favorable economic and social conditions) will be exempt from tax for 2 years and reduce 50% of payable tax for the next 4 years.

Source: https://luathoangsa.vn/dau-tu-vao-khu-cong-nghiep-uu-dai-thue-nhu-the-nao-nd67333.html

Preferential land rental in industrial zones

According to the provisions of Clause 7 Article 3 of the Government’s Decree No. 123/2017/ND-CP, individuals and organizations that rent land in industrial parks will be exempted and reduced from land rent. Each specific case will have a different exemption policy. Therefore, to know the incentives to rent land in the industrial park, investors can contact the investor for specific information.

Source: https://baochinhphu.vn/uu-dai-mien-giam-tien-thue-dat-voi-du-an-trong-cum-cong-nghiep-102300838.html

2. Preferential policies when investing in industrial parks

Incentive policies for investment in industrial parks will depend on the characteristics of the industrial park. Specifically:

Policies to encourage the development of supporting industrial zones

With supporting industrial parks, investment enterprises will enjoy the following incentives:

- Enjoy incentives on corporate income tax, import and export tax and other supports as prescribed.

- If manufacturing products on the list of supporting industry products prioritized for development according to regulations, they will be supported by competent state agencies to carry out the procedures for confirmation of preferences for up to 30 days.

- Priority will be given to participating in training programs, startup support, and business support implemented by state agencies.

Investment incentives in industrial – urban – service zones

Enterprises are entitled to investment incentives in terms of corporate income tax, export tax, import tax, land rent exemption and reduction and other incentives as prescribed by law.

Incentives for businesses in eco-industrial parks

Enterprises in the eco-industrial park will be given priority to provide relevant information on the technology market and cooperation capabilities to carry out production and business activities.

Source: https://www.kizuna.vn/vi/tin-tuc/nhung-van-de-can-quan-tam-khi-dau-tu-vao-cac-khu-cong-nghiep-1086

Ưu đãi với doanh nghiệp trong khu công nghiệp sinh thái

Doanh nghiệp trong khu công nghiệp sinh thái sẽ được ưu tiên cung cấp thông tin liên quan về thị trường công nghệ, khả năng hợp tác để thực hiện các hoạt động sản xuất kinh doanh.

Nguồn: https://www.kizuna.vn/vi/tin-tuc/nhung-van-de-can-quan-tam-khi-dau-tu-vao-cac-khu-cong-nghiep-1086

3. Nam Dinh Vu – Industrial Park is receiving the best investment incentives today

In the industrial real estate market in our country, Nam Dinh Vu industrial park is considered a “golden address” for investors with the best incentives today.

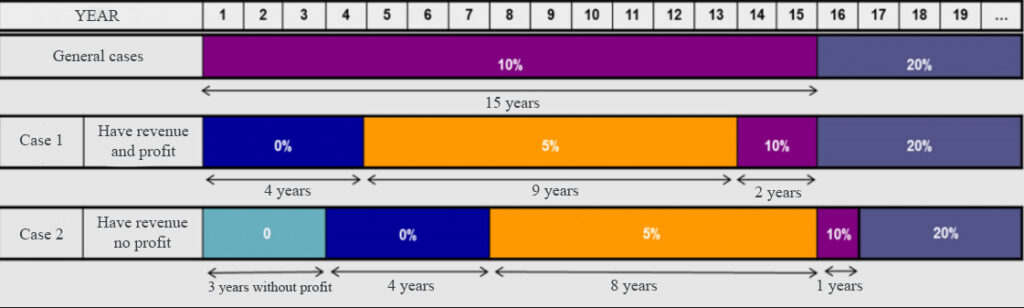

- Corporate income tax incentives: Tax exemption for 4 years and 50% reduction of payable tax for the next 9 years. In addition, the corporate income tax rate will be only 10% (as a rule, 20%) for 15 consecutive years from the first year when the enterprise has revenue from activities entitled to tax incentives.

- Incentives for land use tax: Enterprises are exempted from 100% of land use tax during the project implementation period.

- Special offer: Support businesses to complete legal procedures for free, quickly.

You can learn more about the extremely attractive investment incentives of Nam Dinh Vu industrial park

With many attractive incentives, Nam Dinh Vu Industrial Park is creating a strong attraction for domestic and foreign investors. Those good preferential policies will help businesses facilitate investment, optimize production and business costs, and create competitive advantages.