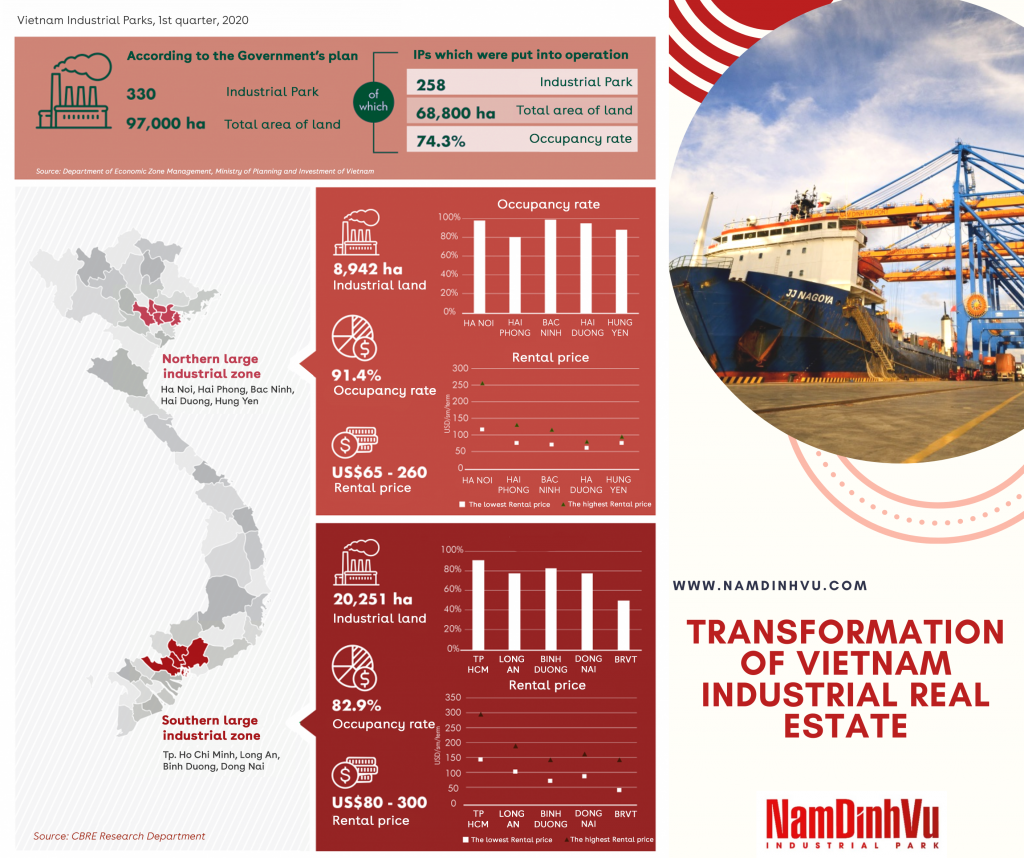

By the end of March 2020, the whole country had 335 industrial parks established, of which 260 industrial parks were put into operation. Leading experts believe that the industrial real estate segment in the period of 2020-2025 will be a “golden opportunity” for investors.

Vietnam is facing a great opportunity to become a new manufacturing center of the world. Especially after Covid 19, the world production trend is limiting dependence on a single market, moving out of China due to high costs and trade conflicts with the United States.

Besides, Vietnam is also recognized as one of the countries with the most stable political institutions in the world; GDP growth rate of Vietnam’s economy is from 6.5 to 6.8%; abundant labor resources with relatively cheap labor prices compared to other countries in the region… These are paramount factors for investors, especially investors in the field of industrial real estate. .

In particular, as a rare country in the world that has succeeded in controlling the Covid-19 epidemic, Vietnam is considered an ideal destination for investors to quickly seek investment opportunities in Vietnam. industrial parks, factories, export processing centers.

Opportunities and challenges of Vietnam’s industrial real estate industry

Rents of industrial parks in major manufacturing cities and provinces have risen sharply in the context of limited industrial land supply. However, there are still many concerns about Vietnam’s ability to absorb this new wave of production relocation, when there are still many challenges such as transshipment risks, the risk of high tariffs due to trade imbalance. limited infrastructure and ecosystem of original equipment manufacturers.

Industrial land for rent is still the most popular and preferred product in the market. However, in recent years, the growth rate of industrial land supply in major provinces and cities is slowing down.

Time and cost are still key factors to be considered. For new businesses, the capital, cost and time required to build a standard factory in a new country can be higher than a pre-built factory and integrated with supporting utilities. aid.

Long-term development potential of real estate in Vietnam

Assessing the demand of the industrial real estate market, Ms. Pham Ngoc Thien Thanh, Deputy Director of Research and Consulting Department at CBRE Vietnam said that efforts to ease trade tensions and policies Preventing tariffs could weaken demand, especially from mainland China, Taiwan, South Korea and Hong Kong in the short term.

The benefits from new trade agreements are a more sustainable driver of market demand. In the context of increased demand from businesses in the processing and manufacturing industries, ready-built industrial real estate is receiving a good response from the market.

In the long-term, according to Ms. Duong Thuy Dung, Senior Director of CBRE Vietnam, the development of industrial land supply will shift to tier-2 industrial cities and provinces thanks to more competitive rents along with occupancy rate is still low.

However, short-term industrial real estate demand in these areas remains low due to weak infrastructure. At the same time, the new supply that is expected to come into operation in the future will limit the strong growth of average rents. Industrial parks with good connections to important seaport clusters will have a rapidly increasing occupancy rate.